Get This Report on Personal Loans Canada

Wiki Article

What Does Personal Loans Canada Do?

Table of ContentsPersonal Loans Canada Fundamentals ExplainedThe 9-Minute Rule for Personal Loans CanadaThe Facts About Personal Loans Canada RevealedRumored Buzz on Personal Loans CanadaA Biased View of Personal Loans Canada

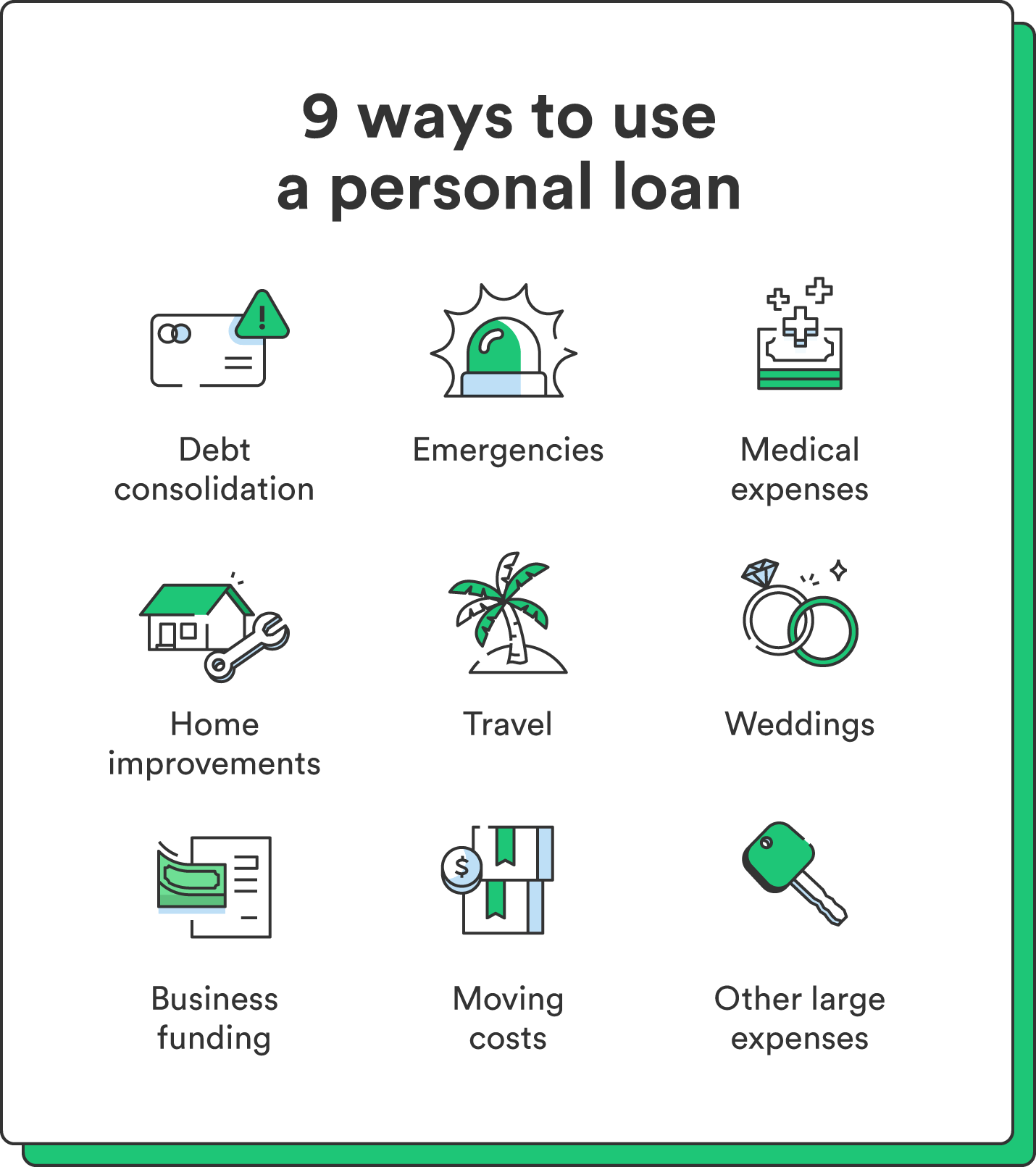

Allow's dive right into what an individual lending actually is (and what it's not), the factors individuals utilize them, and exactly how you can cover those crazy emergency situation expenses without tackling the worry of financial debt. A personal financing is a round figure of money you can obtain for. well, nearly anything.That doesn't include obtaining $1,000 from your Uncle John to assist you pay for Christmas offers or letting your roomie spot you for a couple months' rent. You should not do either of those things (for a variety of reasons), but that's practically not an individual financing. Individual lendings are made via an actual economic institutionlike a financial institution, lending institution or online lending institution.

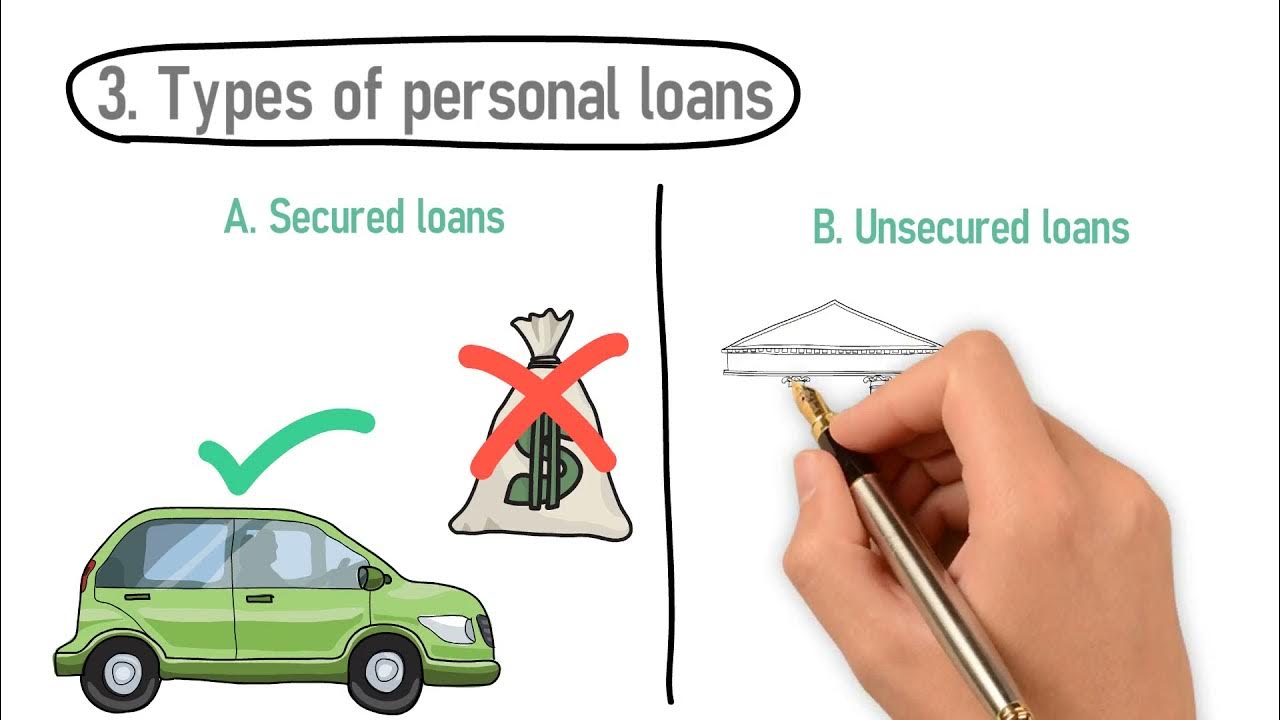

Let's take a look at each so you can recognize exactly just how they workand why you do not need one. Ever. Most individual financings are unprotected, which means there's no security (something to back the finance, like an automobile or residence). Unprotected fundings usually have greater interest rates and need a better credit history because there's no physical item the lender can remove if you do not compensate.

Facts About Personal Loans Canada Revealed

No matter just how great your credit score is, you'll still have to pay passion on a lot of personal financings. Safe personal car loans, on the various other hand, have some kind of collateral to "protect" the financing, like a boat, fashion jewelry or RVjust to call a few.You could likewise take out a secured individual funding utilizing your car as collateral. That's a hazardous relocation! You don't desire your main mode of transport to and from work obtaining repo'ed because you're still spending for in 2014's cooking area remodel. Trust fund us, there's nothing safe about guaranteed car loans.

Just since the settlements are foreseeable, it doesn't mean this is a good bargain. Personal Loans Canada. Like we stated in the past, you're practically assured to pay interest on a personal lending. Just do the mathematics: You'll wind up paying means a lot more over time by getting a lending than if you 'd just paid with money

Examine This Report on Personal Loans Canada

And you're the fish holding on a line. An installment finance is an individual financing you repay in repaired installations gradually (generally as soon as a month) until it's paid in complete - Personal Loans Canada. And do not miss this: You need to repay the original financing quantity prior to you can obtain anything else

However don't be mistaken: This isn't the like a credit card. With line of credits, you're paying rate of interest on the loaneven if you pay on schedule. This type of car loan is super tricky since it makes you believe you're managing your financial debt, when actually, it's managing you. Cash advance financings.

This one obtains us riled up. Why? Due to the fact that these services prey on individuals who can't pay their costs. And that's simply wrong. Technically, these are temporary fundings that give you your paycheck in advance. That might appear confident when you're in a monetary wreck and require some money to cover your costs.

The smart Trick of Personal Loans Canada That Nobody is Talking About

Due to the fact that things get genuine unpleasant real quickly when you miss out on a settlement. Those financial institutions will certainly come after your pleasant grandma that guaranteed the financing for you. Oh, and visit homepage you need to never ever guarantee a loan for anyone else either!All you're actually doing is utilizing new financial debt to pay off old financial obligation (and extending your financing term). Companies recognize that toowhich is precisely why so many of them use you consolidation finances.

:max_bytes(150000):strip_icc()/pros-cons-personal-loans-vs-credit-cards-v1-4ae1318762804355a83094fcd43edb6a.png)

And it begins with not borrowing anymore money. ever before. This is an excellent regulation of thumb for any type of financial acquisition. Whether you're thinking about taking out an individual loan to cover that cooking area remodel or your overwhelming bank card bills. don't. Obtaining financial obligation to pay for things isn't the method to go.

The 7-Minute Rule for Personal Loans Canada

And if you're considering an individual lending to cover an emergency situation, we obtain it. Obtaining money to pay for an emergency only escalates the stress and hardship of the situation.

Report this wiki page